The accounts receivable journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable. Get the right guidance with an attorney by your side.

Allowance Method For Bad Debt Double Entry Bookkeeping

The IRS says that bad debts include loans to clients and suppliers credit sales to customers and business loan guarantees and that a business deducts its bad debts in full or in part from gross income when figuring its taxable income.

. The Bad Debts Expense remains at 10000. King with mane in Tamil is a 2014 Indian Tamil-language 3D animated action film written by K. A liability is a companys financial debt or obligations that arise during the course of its business operations.

It would be double counting for Gem to record both an anticipated estimate of a credit loss and the actual credit loss. Rajinikanth also Soundaryas father. Bad Debts Written Off Income Statement 2000.

Get the right guidance with an attorney by your side. Let us help you get Bad Credit Vehicle Finance today. General trading stock rules.

Normal Balance Side Quiz. Someone who makes sense is reasonable or shows good. PDF Link for emailed invoices.

In this example estimated bad debts are 5000. Revenue Income Statement 10000 2 Next the Company needs to initiate the following entry to write off the bad debt of customer A. A government system or private organization that is responsible for a particular type of.

Accounting for trading stock. Ravikumar and directed by Soundarya RajinikanthIt is Indias first photorealistic motion capture film featuring characters whose designs were based on the appearance and likeness of their respective actors. Our network attorneys have an average customer rating of 48 out of 5 stars.

Accounting for bad debts. Was this information helpful. Lets help you today get blacklisted vehicle finance.

A bad debt amount of 500 will. Trying to get a car but do not qualify through the normal channels. Debit bad debt provision expense PL 100.

It is not directly affected by the journal entry write-off. A Breaking Bad Movie or simply El Camino is a 2019 American crime thriller filmPart of the Breaking Bad franchise it serves as a sequel and epilogue to the television series Breaking BadIt continues the story of Jesse Pinkman who partnered with former teacher Walter White throughout the series to build a crystal meth empire based in Albuquerque. Using stock for private purposes.

Liabilities are settled over time through the transfer of economic. If the account has an existing credit balance of 400 the adjusting entry includes a 4600 debit to bad debts expense and a 4600 credit to allowance for bad debts. Yes we can help you get bad Read More Bad Credit Vehicle Finance.

If a company has 500000. Credit Bad provision 100 BS. Debit Credit Accounting Quiz.

The following accounting double entry will be passed in the books of the company. Supplier overpayments and double payments. After the January 1 reversing entry the account Accrued Expenses Payable will have a zero balance and the account Temp Service Expense will have an unusual credit balance of 18000.

Blacklisted vehicle finance has never been easier. 1 The original double entry when the Company billed customer A is. Trade Debtor Balance Sheet 10000.

Trading stock and the treatment of proceeds from the sale of. This means that the company has recognized a loss against the receivables from ABC Company. In each case the accounts receivable journal entries show the debit and credit account together with a brief narrative.

The double entry would be. Our network attorneys have an average customer rating of 48 out of 5 stars. Pay Now Button missing intermittently on emailed invoices.

Percentage of credit sales method. Ser Jaime Lannister was the elder son of Lord Tywin Lannister younger twin brother of Queen Cersei Lannister and older brother of Tyrion LannisterHe was involved in an incestuous relationship with Cersei and unknown to most he was the biological father of her three bastard children Joffrey Myrcella and Tommen as well as her unborn child. Try Another Double Entry Bookkeeping Quiz.

To be clear and easy to understand. Been declined for affordability bad credit history or credit score too low. The accounts receivable test is one of many of our online quizzes which can be used to test your knowledge of double entry bookkeeping discover another at the links below.

Change in invoice recordng payment allocation. Bad debt can also result from a customer going bankrupt and being financially incapable of paying back their debts. Work out taxable income.

Some companies estimate bad debts as a percentage of credit sales. Debit Bad debts 500 PL Credit Receivables account 500 BS This entry will directly affect both the income statement and balance sheet. When the temp agencys invoice dated January 6 arrives the retailer can simply debit the invoice amount to Temp Service Expense and credit Accounts Payable the normal routine procedure.

The bad debts expense recorded on June 30 and July 31 had anticipated a credit loss such as this. This could be because the amount you have outstanding from your customers has gone up therefore you expect more debts to go bad or you have implemented a new credit control procedure so less debts are going bad. Deductions for unrecoverable income bad debts Concessions offsets and rebates.

Simpler trading stock rules. Activity statement showing a random PO number for a payment.

Bad Debt Provision Meaning Examples Step By Step Journal Entries

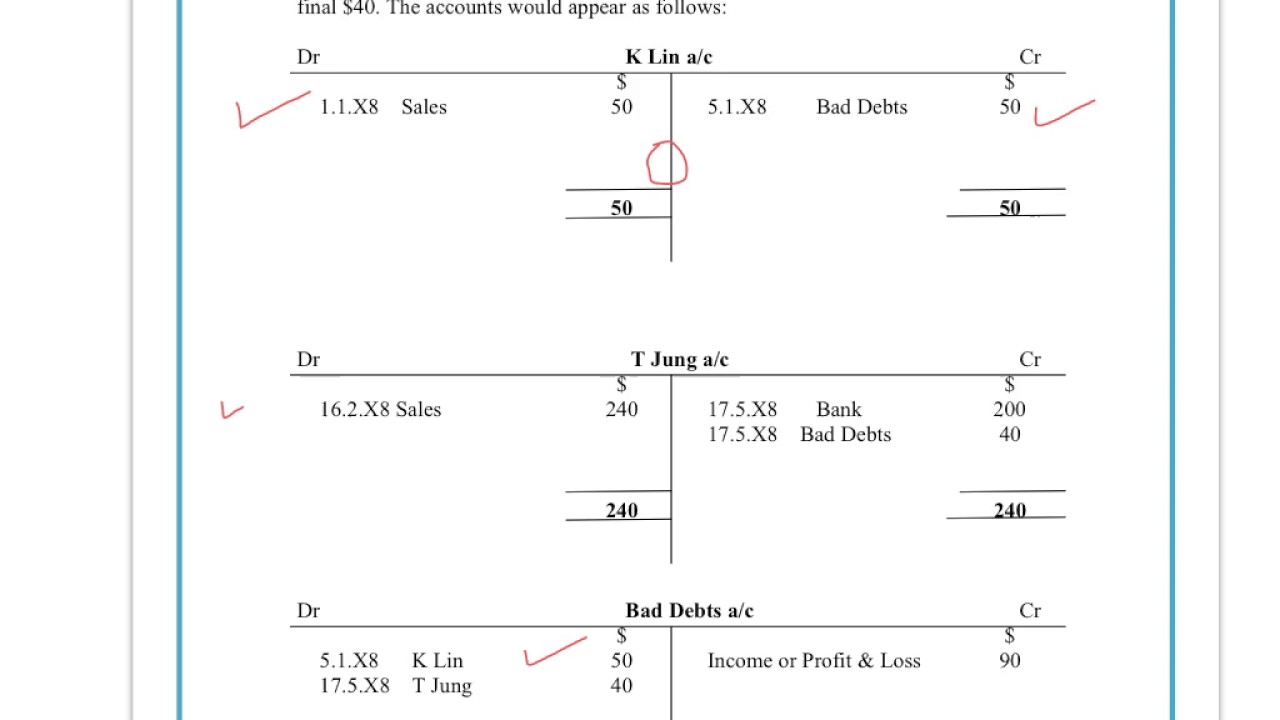

Igcse Gcse Accounts Understand How To Enter Bad Debts Transactions Using The Double Entry System Youtube

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

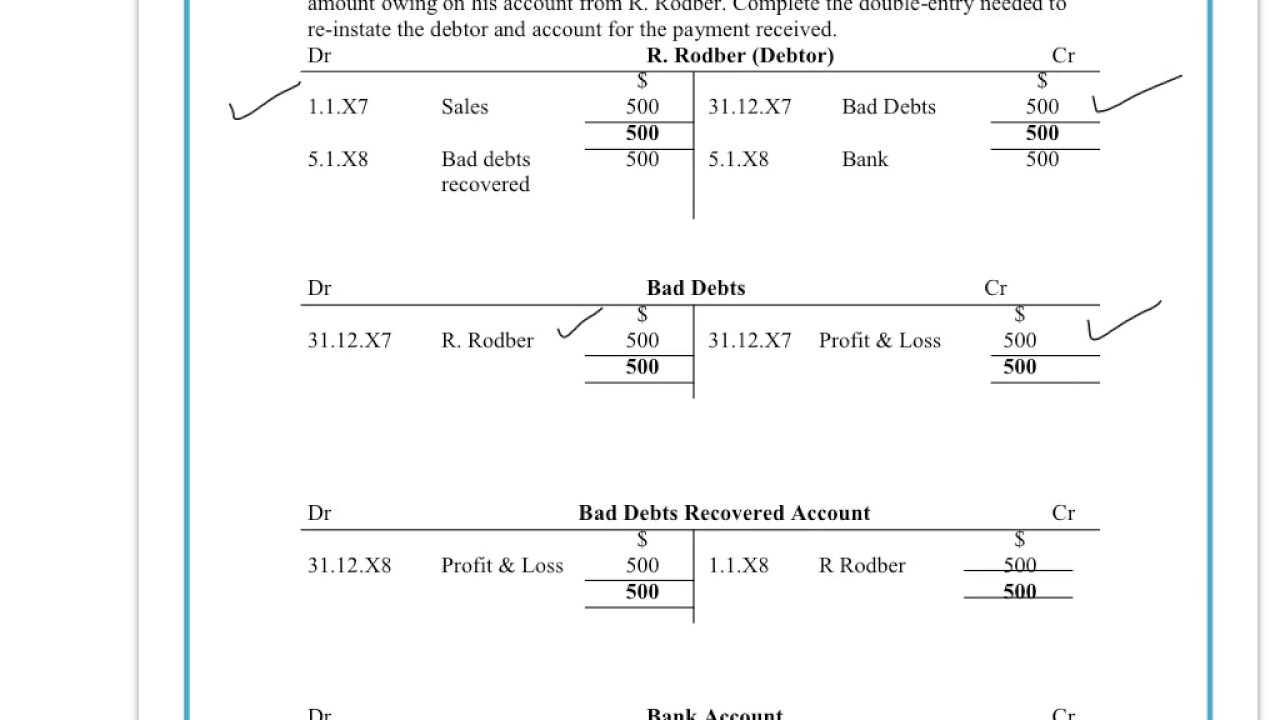

Understand How To Enter Bad Debts Recovered Transactions Using The Double Entry System Youtube

0 Comments